Six Sigma Trends: Six Sigma in Financial Services

Editor | On 16, Apr 2006

Elena A. Averboukh

LUSI – Centre eG

( Interdisciplinary Centre for Quality of Life and Usability Studies )

www.sixsigma-24.de

Here is a new article reflecting our on-going research on advanced tools, strategies and trends in deploying six sigma particular in financial services.

Our evaluation is based on

• practical leadership in deployment, training and project coaching for financial institutions as well as for their IT vendors over the globe

• basic research in the field of efficient methodologies for adult learning within international research network.

Six Sigma wave has finally reached European financial institutions, as well as South African etc., and spreading quickly further to the East Europe and Far East/Pacific improving the overall capability of the global financial processes and operations. Here we present main trends in Six Sigma global deployments which are sometimes hidden but coming inevitable along with market and technology evolution. These trends are certainly not unique and to major extent can be observed in Six Sigma evolution across other transactional, e-business and even manufacturing businesses. I will appreciate your responses and I am thankful also in advance for any feedback, questions and discussion.

1. High-Level Financial Business Processes

Let us first visualise high-level financial business processes schematically, e.g. using SIPOC (Suppliers, Inputs, Process, Output, Customers). Core business is certainly about

• creating growing and sustainable margin between getting Money-In and giving Money-Out,

• satisfying just-in-time requests for money-related products and/or services, and

• using when needed internal and/or external services from the vendors.

Is it simple like that, as shown in Fig.1!?

Fig.1 High-level SIPOC for Core Financial Business Process

Yes and No, because all nodes and links on the above SIPOC figure are

• increasingly dynamic, non-stable and often season- and location (i.e., continent, country, culture etc., of both source and receiver)-dependent

• most attractive subjects for fraud, falsification etc.

• subjects of strict and emerging state regulations and restrictions,

• TOTALLY IT Systems –dependent and –driven.

2. What Drives Evolution of Financial Business Processes?

Evolution of any system and/or process is driven by contradictions and/or lack of resources within the system and/or it’s sub-systems and/or environment, needed to reach system’s objectives and to fulfil it’s functionalities. What are the main bottlenecks or contradictions in Financial Business System and related Business Processes?

Those are certainly contradictions between VOC (Voice of Customer)- VOB(Voice of Business)-VOM (Voice of Market)-VOT (Voice of Technology)

• VOC: Customer loyalty especially towards the lead time for getting service or product is decreasing

• VOB: Costs for providing multilingual and multimedia global services with high security level are increasing

• VOM: Rapidly evolving “unexpected†competitors, i.e. financial service and products providers, particularly over the Internet

• VOT: Regular Upgrade and Decomission of IT Platforms, IT Solutions, as well as Legacy (Sub) Systems etc. becomes a core business process, which enables and effects the whole business capability and vitality.

3. How Financial Institutions Deploy Six Sigma?

Training Curriculum

First global financial institutions in US have started their deployments since 10-15 years particularly with training Black- and Green-Belts in applying classic DMAIC and later DFSS Roadmaps.

Later, particularly in order to reinforce these deployments and to harmonise parallel initiatives on business process improvements, Lean Manufacturing and Six Sigma Initiatives were unified and managed, particularly as a joint (two-in-one!) Lean Six Sigma Programme.

There is currently a lot of discussions in media about what does Lean Six Sigma mean and whether it is “better†than just Six Sigma or not.

As Six Sigma Roadmap and Framework are definitely broader and comprise Lean methods and applications as special cases and natural part of it anyway, the whole discussion has mostly marketing flavour.

One of the common problems in training practices seem to be rather low culture of the competence development for Black- and Master Black Belts. Master Black Belts are usually asked to train 5-6 groups of Black- and Green Belts annually and to provide related coaching of hundreds of the projects. Such training and consulting load apparently leaves no time for their personal competence development, as well as for the regular upgrade of the training materials etc., and may lead to burn-out and losing best professionals leaving the businesses.

Current Deployments in Six Sigma “Novice-Organisationsâ€

It is quite surprising that financial institutions outside US who are just now starting to implement Six Sigma are facing rather contradictive information in the media and from diverse consultants and often start with deploying simplified Lean Sigma training programmes at middle management or project leaders levels.

Simplified training along with limited responsibilities and rights of the first Belts certainly influence the projects selected and implemented first hand (waste reduction) as well as the whole deployment flow and reduces its impact as well as payback.

These projects usually do not cover the whole business processes from the very start to the end. They focus on local improvements within relevant “silos†(departments). It often leads to doubling the efforts on the product improvement across diverse products and services. It may become useless as soon as any re-organisation, merge, automation, IT upgrade etc. takes place (what actually is happening permanently).

Result and business impact is therefore usually pretty modest, especially in such dynamic, unstable, high-risk and high-tech environments as financial business processes. The improvements made are rarely sustainable at least over the year after their implementation, as the processes change quicker than annual saving from the waste reduction can be obtained, e.g. when new IT solution is introduced or upgraded etc.

Deployment Schemes

Both deployment schemes can be observed in the financial business area, i.e.

• Top-down, starting with leadership training and commitment, and extensive training of about 1% of employees as a full-time Black Belts and about 20% time Green Belts, and

• Bottom-Up, starting from training few professionals and piloting rather scalable projects in order to win attention and recognition and then proceed with broader scale deployment

Certainly, both strategies have pros and contras and should and may be used efficiently both ways depending on companies size, culture, location, financial status, etc.

“IT-Avoidanceâ€

Majority of financial institutions according to our survey try to “ignore†IT business processes and run the deployments, sometimes over many years without training IT employees as Six Sigma Black- and/or Green Belts. This undermines the impact of Six Sigma deployment significantly, as IT business processes ARE IN THE MIDDLE of the core financial processes (see Fig.2), enabling and supporting them.

Fig. 2 IT Processes are in the Middle of the Financial Business Processes Once recognised, the rework of initial deployments becomes inevitable and, therefore, consequent COPQ (Cost of Poor Quality) of the initial Six Sigma deployments starts to be visible and pretty high!

Why there is a tendency to “ignore “ IT when deploying six sigma?

There are many apparent reasons for this, particularly:

• To be able to train IT staff in Six Sigma, six sigma instructor or Master Black Belt has to be also an expert in advance IT process models, methods and tools, which is still a big rarity

• Controlling system in the whole organisation should be changed in order to track efficiently the Cost of Total Ownership of IT systems

• Business Requirements Engineering for IT should be changed considering state-of-the-art methods, which are usually not yet the part of the classic Six Sigma training (VOC) and demand extra training of business and IT analysts and Sigma Belts together

• Classic training programmes mostly comprise statistical methods and tools dealing with complete, representative data, which are normally distributed. In IT processes major business metrics like dependability, reliability, maintainability, availability etc. are based on incomplete, censored and highly uncertain life data, which are not normally distributed and require different tools beyond the classic Six Sigma curriculum, etc.

4. Evolution Trends in Six Sigma Deployments

From Tactics to Strategy

There is more and more understanding in management circles that Six Sigma is a strategic initiative which should not only FOLLOW the company’s strategy (i.e. be linked to the Balanced Score Card), but also LEAD strategy development and – maintenance using advanced six sigma and innovation methods, tools and management practices.

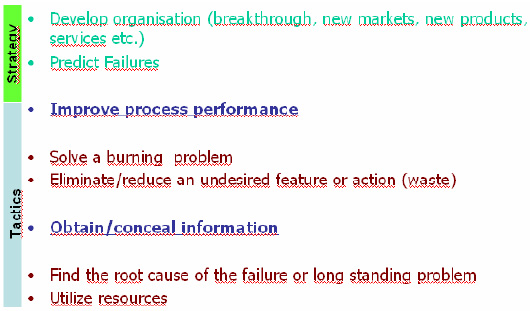

As shown in Fig.3, strategic objectives become also a source for launching relevant six sigma business cases and projects.

Fig.3 Six Sigma Busines Cases: strategic vs operational

Failure Prediction as well as Securities related Business cases are getting more and more attention within Six Sigma deployments. Advanced TRIZ tools are particularly used in relevant projects.

Fellow Master Black Belts/ Master Black Belt / Black Belt roles Mentioned above “upgrade†of Six Sigma in order to support strategic business decision making certainly demands redefining of the roles, responsibilities and involvement of Master Black Belts and Black Belts. There is a strong tendency to distinguish Fellow Master Black Belts from traditional Master Black Belts, who are reporting to CEO, are involved in training of Black Belts and other Master Black Belts only about 10-15% of their time, spending the rest on defining and coaching strategic business cases, projects and co-managing the subordinate pipeline of the Black- and Green Belt projects, as well as training programmes development and training trainers. For these role the most efficient, recognised, successful and experienced Master Black Belts are usually selected.

IT Recognition

Fortunately, in spite of mentioned above difficulties and barriers, we start to train Green- and Black Belts in IT departments within financial organisations, as well as their IT vendors.

Typical business cases in Six Sigma for IT are “IT Supplier Evaluation†and “IT Vendor’s Contract Managementâ€, and it immediately effects and challenges Financial IT Vendors to raise an awareness and to start “mirror†internal Six Sigma deployments.

It is sad, that it is usually done by IT Vendors only under the threat of losing the clients (especially in Europe) when not being capable to meet their IT dependability requirements. But at the same time it is rewarding and a big progress that this “grey area†is highlighted and spoken loud, at least under the pressure, which gives enormous business impact and quick ROI to those who start taking and implementing it serious.

Far East and Pacific IT organisations are implementing Six sigma in a rather broad scale and very successfully since many years and now they are focusing their projects more and more on the innovative design of new financial products and services, and only shadowing improvement of the relevant business processes as something apparent and out of discussion any more. And it certainly drives global competition and should not be overseen.

Training Programmes

Advanced training programmes are certainly not at all limited to the Lean methods and tools within the classic Six Sigma framework.

They become relevant for training business financial, as well as IT professionals together and cover not only financial business process improvement methods and tools, but also advanced tools for IT-based business products- and services design, innovation and relevant process improvement and financial and business metrics monitoring (including ITIL).

Relevant requirements engineering and reliability engineering methods and tools are incorporated where appropriate in DMAIC and in DFSS curriculum. Separate competence development modules are used to upgrade Black- and Green Belts in order to be able to efficiently communicate with IT professionals during the requirements definition phase, as well as evaluation and control phases etc. These practices will certainly result in bringing up many new IT- and e-business fit Master Black Belts, which are so much demanded by the Six Sigma employment market…earliest in 2-3 years although.

Companies start slowly to recognise resource limitations in regular upgrading of the training materials as well as of the competencies of their Master Black Belts, Blackand Green Belts. We particularly observe this tendency by increasing number of requests to license materials for our new training modules as well as to train the trainers in using them for internal trainings.

Using TRIZ Tools

More and more Black Belt training programmes comprise advanced TRIZ tools in order to

• Support adequate definition and analysis of improvement opportunities, of the relevant project ideas and problem statements,

• Perform efficient tool-based failure analysis and failure prediction,

• Accelerate innovative and efficient generation and evaluation of new ideas on product/process improvement or (re-)design

• Develop and evaluate efficient error-prone solutions for improving overall business process capability, etc.

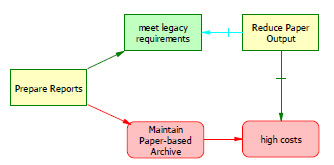

Below Fig.4 shows a typical simple example of TRIZ problem modelling in terms of useful (prepare reports, meet legacy requirements, reduce paper output) vs harmful functions or effects (maintain paper-based archive, high costs). Interactions between them i.e. “produce- being produced by†or “counteract-being counteracted by†are depicted with arrows or crossed arrows appropriately.

Fig.4 Initial Problem statement for Six Sigma Project “Reduce Archive Costs†An exhaustive list of alternative opportunities for improvement (so-called Directions for Innovation, see Fig.5) can be generated automatically, e.g. using IWB software (Innovation Workbench, Ideation International Inc.) as following, when working on a Project Team Charter during it’s Define Phase

Fig. 5 Exhaustive level of high-level options for improvement opportunities This list is generated automatically on a basis of the above problem model and encourages project team leaders and members to re-evaluate the initial project direction and to prioritise, to allocate tasks and to consider more than just one or two alternatives to proceed before the quick-fixes are made. Listed top-level options actually all make sense and enable and support out-of-box thinking and focused discussions between project team members and process stakeholders etc.

After prioritising and selecting a particular improvement opportunity (direction for innovation), one can use further TRIZ tools in order to generate relevant solutions and then to combine them in efficient and error-prone business improvement concepts.

Global Deployments

Frequently asked question: how to efficiently proceed with global deployment of Six Sigma across the continents, countries, cultures etc.

Best practices show the efficiency of running the training and upgrade activities, particularly for the Black and Master Black Belts within the mixed international groups. This particularly supports building an efficient corporate network of six sigma professionals, trained and coached by the same instructors.

Still the deployment strategies should consider local cultures, business specifics as well as local “runners and bottlenecksâ€. In advanced Six Sigma organisation this is within the role of Fellow Master Black Belts to coordinate and control the deployments which are supporting the corporate strategy.

5. Discussion

This article particularly focuses on the trends and advanced practices which increase business impact of Six Sigma deployments particularly in Financial Service Organisations.

This is a very dynamic, highly competitive and high risk business application environments, were business processes are IT-enabled and -dependent and usually have a seasonal character. Growing competition especially via the Internet, as well as increasing risks of fraud and misuse forces corporate Six Sigma implementation and broad scale deployment in financial organisations, including IT processes. These tendencies can be certainly observed in other transactional, as well as in global highly automated e-businesses etc.

Any comments, observations and practices which readers of this article may share, are very much welcome.

Dr. Elena Averboukh is an industry-funded professor at the University of Kassel (Germany) in Quality and Safety Control Systems and works internationally as a Six Sigma and TRIZ Master Instructor and Fellow Master Black Belt for manufacturing, transactional, design, financial and e-business companies (www.sixsigma-24.de). She has two Master degrees in electrical/system engineering and in mathematics/computer science and three Doctoral degrees in process automation, modelling and identification of complex systems and in quality and safety control systems. She may be reached via e.averbukh@ieee.org.